10 things you need to know about tax and private health insurance

On this page

- Tax statements explainer

- Where tax statements are sent

- How to find your statement

- Pre-filling details

- Avoiding the Medicare Levy Surcharge

- Private health rebate

- The 2 things that can affect your rebate

- Changing your rebate level

- Lifetime Health Cover loading

- Planning for the future

For some, health insurance can be lumped into the ‘set and forget’ category, but in tax time it can play a bigger role than you might think.

Here are 10 things you should know to stay informed—and potentially save money.

1. Police Health private health insurance tax statements are sent to the ATO

If you’re a member, your Private Health Insurance (PHI) Tax Statement will include details of the number of days you have been covered by an appropriate level of private hospital cover during the last financial year with Police Health.

The Australian Tax Office (ATO) uses this information when assessing if you will be subject to the Medicare Levy Surcharge.

Your PHI Tax Statement will also outline;

- Your allocation (if any) of the Australian Government Rebate on private health insurance (Rebate)

- If you have received this Rebate as a reduction in your premiums.

It will also be used to assess any liability or offset.

2. Police Health doesn't send PHI Tax Statements to members

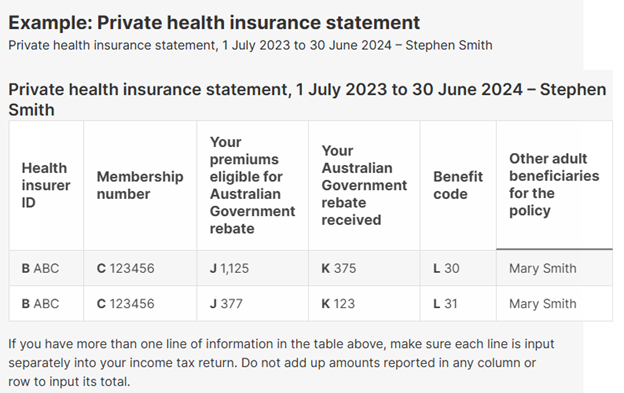

As we send your PHI Tax Statements directly to the ATO in the first week of July, this information usually pre-fills in your tax return. Here's an example from the ATO website.

However, if you're lodging early or through an accountant, your statement can help confirm the details.

3. You can find your Tax Statement in our app and member portal

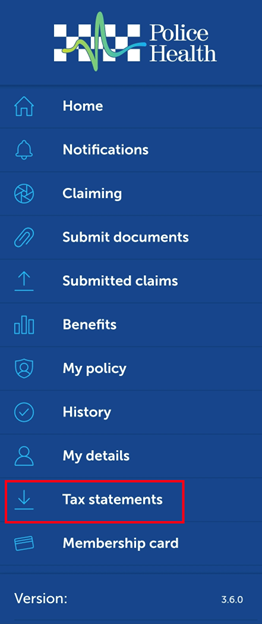

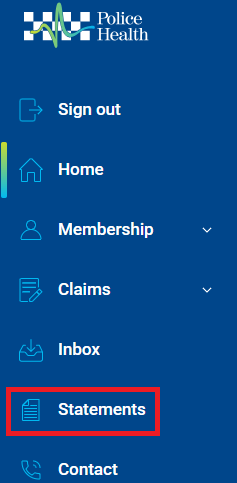

Policy Holders will be able to download a copy after 8 July from our online Member Portal or Mobile App (Android / Apple).

In the portal and app, you can find our tax statement by selecting ‘Statements’ from the left-hand side menu.

4. You shouldn't have to add your private health details to your tax returns

As we send your tax statements to the ATO, this usually means the details of your private health insurance are pre-filled in your tax returns.

This includes details like your health fund ID, benefit code, total premiums paid, rebate amount received, and the number of days you held an appropriate level of hospital cover.

It’s still a good idea to double-check the information against your tax statement, especially if you're lodging early or through an accountant.

5. Keeping your hospital cover means you may avoid the Medicare Levy Surcharge

As of 1 June 2025, if you earn $97,001 or more (singles) or $194,001 (couples) and don't have private hospital cover like our Gold Hospital or Gold Combined, you may have to pay the Medicare Levy Surcharge (MLS).

That’s at least $970 extra tax for singles or $1,940 for couples, and the surcharge increases the more you earn.

The families’ threshold is increased by $1,500 for each dependent child after the first. Families include couples and single parent families.

Threshold

Base Tier

Tier 1

Tier 2

Tier 3

Single

$101,000 or less

$101,001-$118,000

$118,001-$158,000

$158,001 or more

Family

$202,000 or less

$202,001-$236,000

$236,001-$316,000

$316,001 or more

Medicare Levy

Surcharge0%

1%

1.25%

1.5%

You can read more in our MLS guide.

6. You should check if you're receiving the private health rebate and at which rate

Through the Private Health Insurance Rebate, the Australian Government may pay up to 32% of cost of your private health insurance (based on age 70+ on Base Tier).

How much they pay depends on your age and how much you earn. The less you earn, as a single or couple, means you get a bigger rebate.

Singles Families |

Base Tier <$93,000 <$186,000 |

Tier 1 $93,001-$108,000 $186,001-$216,000 |

Tier 2 $108,001-$144,000 $216,001-$288,000 |

Tier 3 >$144,001 >$288,001 |

|---|---|---|---|---|

| < Age 65 | 24.608% | 16.405% | 8.202% | 0% |

| Age 65-69 | 28.710% | 20.507% | 12.303% | 0% |

| Age 70 + | 32.812% | 24.608% | 16.405% | 0% |

7. There are 2 things that affect your rebate

Those are income change and marital status change.

Income change

If your income goes up or down significantly, you might qualify for a different rebate tier. This could mean getting a bigger discount or even losing eligibility altogether.

Marital status change

Getting married, separated, or divorced can affect your rebate tier. As a couple, your income is combined, potentially pushing you into a different tier.

8. If these change, let us know

If any of the above circumstances change, you contact us at any time and we'll update your rebate if required. Contact us by;

- Phone - 1800 603 603

- Email – enquiries@policehealth.com.au

9. Lifetime Health Cover Loading doesn't apply to your rebate

If you have Lifetime Health Cover (LHC) loading, the private health insurance rebate does not apply to the LHC component of your cover.

You can think of the LHC loading as a surcharge for not having insurance earlier.

The government discount only applies to the regular cost of your insurance, not the surcharge.

10. A little planning goes a long way

To make tax time easier:

- Update your income tier with us if needed

- Check you have the right cover to avoid the MLS

- Ask for help if you’re unsure—we’re here for you

Disclaimer: this is not financial advice

The information provided is general in nature and does not take into account your personal financial situation, needs or objectives. It is not intended as financial advice and should not be relied upon as such. Before making any decisions, you should consider whether the information is appropriate for your circumstances and seek advice from a qualified financial adviser if necessary. While we aim to ensure the information is accurate and up to date, we make no guarantees and accept no liability for any loss or damage arising from reliance on this information.